Renters Insurance in and around Shelbyville

Renters of Shelbyville, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

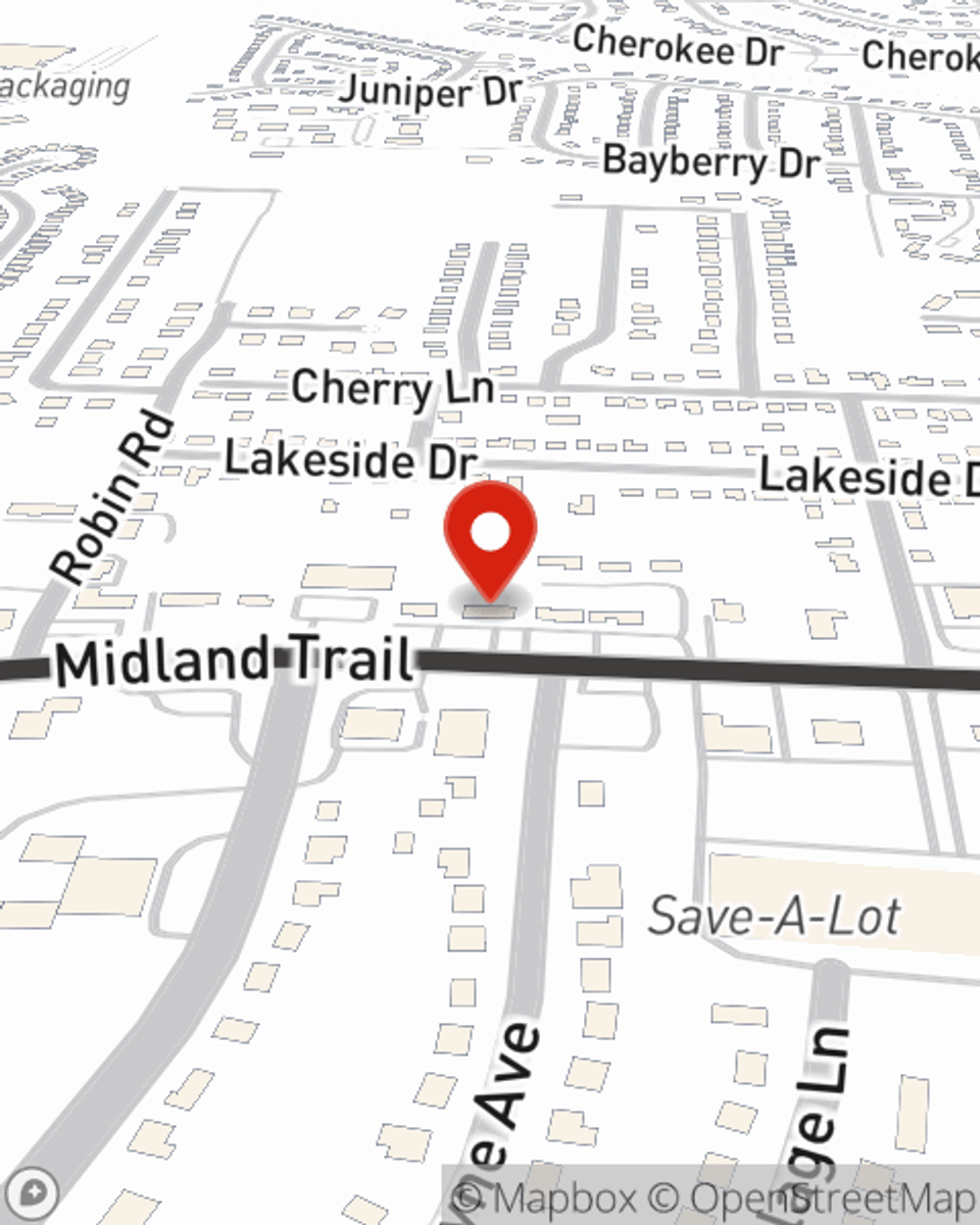

- Shelbyviile, Ky

- Simpsonville, Ky

- Taylorsville, Ky

- Eminence, Ky

- Lawrenceburg, Ky

- Mt Eden, Ky

- Bagdad, Ky

- Jefferson County Ky

- Shelby County, Ky

- Franklin County, Ky

- Spencer County, Ky

- Henry County, Ky

- Anderson County, Ky

There’s No Place Like Home

Think about all the stuff you own, from your entertainment center to clothing to running shoes to camping gear. It adds up! These valuables could need protection too. For renters insurance with State Farm, you've come to the right place.

Renters of Shelbyville, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Agent Jim O'donoghue, At Your Service

Renting is the smart choice for lots of people in Shelbyville. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance probably covers an abrupt leak that causes water damage or smoke damage to the walls, that won't help you replace your possessions. Finding the right coverage helps your Shelbyville rental be a sweet place to be. State Farm has coverage options to accommodate your specific needs. Thank goodness that you won’t have to figure that out alone. With personal attention and reliable customer service, Agent Jim O'Donoghue can walk you through every step to help you helps you identify coverage that safeguards the rental you call home and everything you’ve invested in.

More renters choose State Farm® for their renters insurance over any other insurer. Shelbyville renters, are you ready to talk about the advantages of choosing State Farm? Get in touch with State Farm Agent Jim O'Donoghue today to see what a State Farm policy can do for you.

Have More Questions About Renters Insurance?

Call Jim at (502) 633-2281 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Jim O'Donoghue

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.